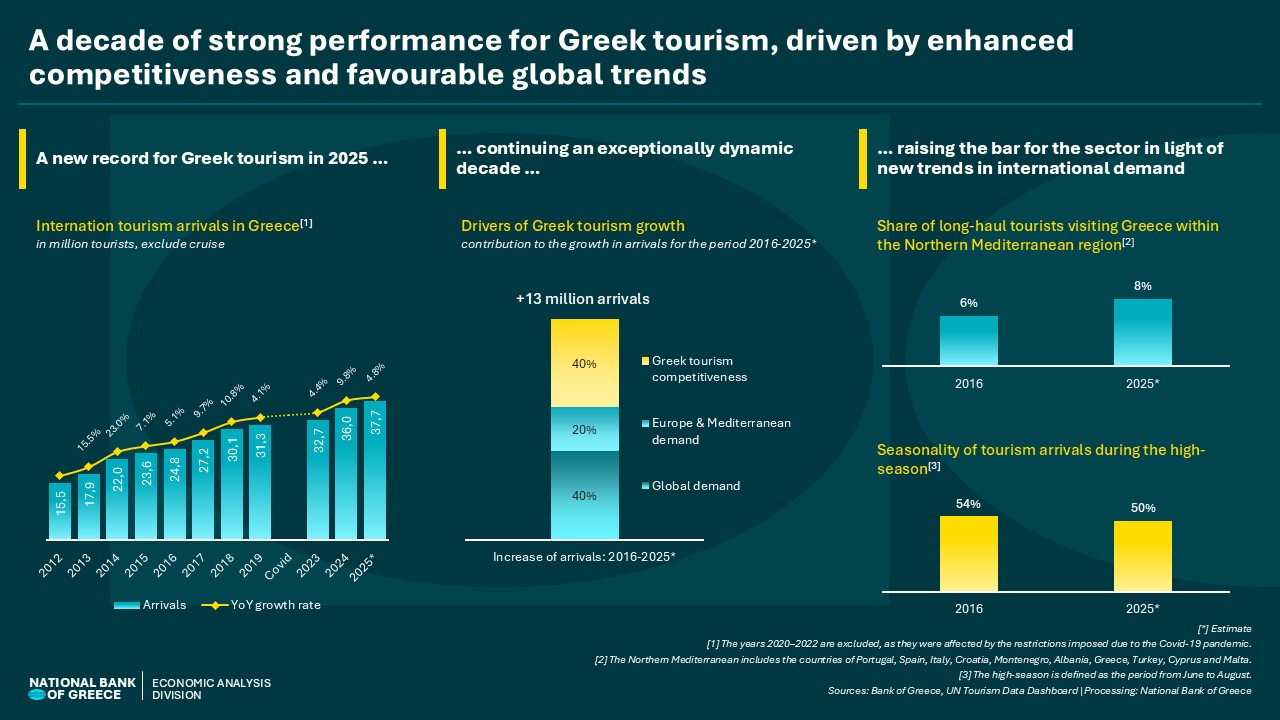

Greek tourism is heading towards a new record in 2025, as international arrivals are expected to exceed 37 million (+5% compared to 2024). Although seismic activity in Santorini acted as a constraint during the first half of the year (+0.6%), the sector’s momentum confirmed its strong structural trend with a steep rise in the second half (approximately 7%). Notably, this momentum shows no signs of exhaustion, as airline bookings for the first quarter of 2026 are already 10% higher than for the corresponding period of 2025.

Over the past decade (excluding the pandemic period), Greek tourism has consistently broken records, adding 13 million new international arrivals. A more detailed analysis reveals that about 40 per cent of this growth stemmed from the overall expansion of the global tourism market, which created favourable conditions for all destinations. An additional 20 per cent is associated with the shift in international demand towards our wider regional market (Europe-Mediterranean), which has strengthened its position on the global tourism map. The remaining 40 per cent, however, constitutes a net gain for Greece, reflecting the strengthening of the country’s share relative to direct competitors within its “neighbourhood”. In other words, Greece’s rise is the combined result of favourable international trends and an improvement in its competitive position. This is the evident from its market share, which reach 2.5 per cent in 2025, up from 2.0 per cent in 2016, ranking Greece among the top five destinations in the regional market, with the greatest market share gain over the last decade.

However, this success is unfolding within a changing tourism landscape:

- In the northern Mediterranean, Turkey and Albania are advancing assertively, recording significant market share increases within the regional market (+3.0 and +0.8 percentage points respectively over the last decade).

- In the southern Mediterranean, Egypt, Tunisia, and Morocco are making a robust comeback, raising their combined share in the regional market by 2 percentage points, leveraging competitive prices, lower saturation and improved geopolitical stability.

- Meanwhile, mature European destinations (such as the UK and France) as well as traditional Mediterranean destinations (such as Italy and Spain) are losing ground (with a cumulative loss across the four countries of 3 percentage points) – indicating that they are approaching the natural limits of their tourism development as defined by the models of previous decades.

Greece’s overperformance to date has not been accidental. It has been based on solid structural foundations – primarily the enhancement of hotel quality and the expansion of air connections, which have underpinned its growth so far. The critical question is what will be required to ensure that this success endures. In a competitive tourism neighbourhood, with new emerging trends in demand side, those who can respond with agility and effectiveness will be the winners. In this context, it is positive that:

- At a time when long-haul travellers are anticipated to account for approximately a quarter of new demand in the regional market, connections between Greece and mature long-haul markets (such as the USA), as well as emerging ones (such as China and India), are being strengthened.

- The strong seasonality of Greek tourism is beginning, slowly but steadily, to recede, as tourist flows – which continue to rise – are being distributed more evenly throughout the year. Specifically, the summer period now accounts for 50 per cent of arrivals, down from 53 per cent five years ago, though still exceeds the Mediterranean average (40 per cent).

Overall, Greek tourism stands at a turning point, as mature destination strategies are reaching their limits and new sources of competition are emerging. Transforming strong demand into sustainable economic value and long-term resilience requires an organized effort along two key axes:

- First, by highlighting the country’s “hidden treasures” through the promotion of alternative destinations (given that the islands absorb almost half of the arrivals while covering just 15per cent of the country’s territory).

- Second, by restoring investment in essential infrastructure to pre-crisis levels (as, over the past five years, it remains 8per cent lower) to keep pace with investment momentum in tourism sector (which is 14 per cent higher than pre-crisis levels). In this way Greece will demonstrate its ability to manage its own success.

See the infographic: