Tourism recorded strong growth in 2024, reaching a new all-time high in arrivals (36 million, +10% annually) and revenues (€21 billion, +4% annually). At the same time, the trend of gradually reducing seasonality continued, as the stronger growth in all three low-demand periods (spring: +21%, autumn: +9% and winter: +16%) compared to summer (+6%) led to a 2-percentage point decrease in the summer months’ share of total arrivals (50% in 2024 from 52% in 2023).

For 2025, the global tourism market expects growth of 3%-5%, with Greece showing potential to exceed this trend based on leading indicators. However, elements of uncertainty remain as (while the situation in Santorini is stabilizing) global pressures persist due to disruptions in EU-US relations and aggressive tariff policies (consumer confidence index in key markets hitting a 12-month low in the first two months of the year).

Nevertheless, beyond current challenges, Greek tourism must remain focused on its long-term strategic goals, capitalizing on global tourism trends. Specifically:

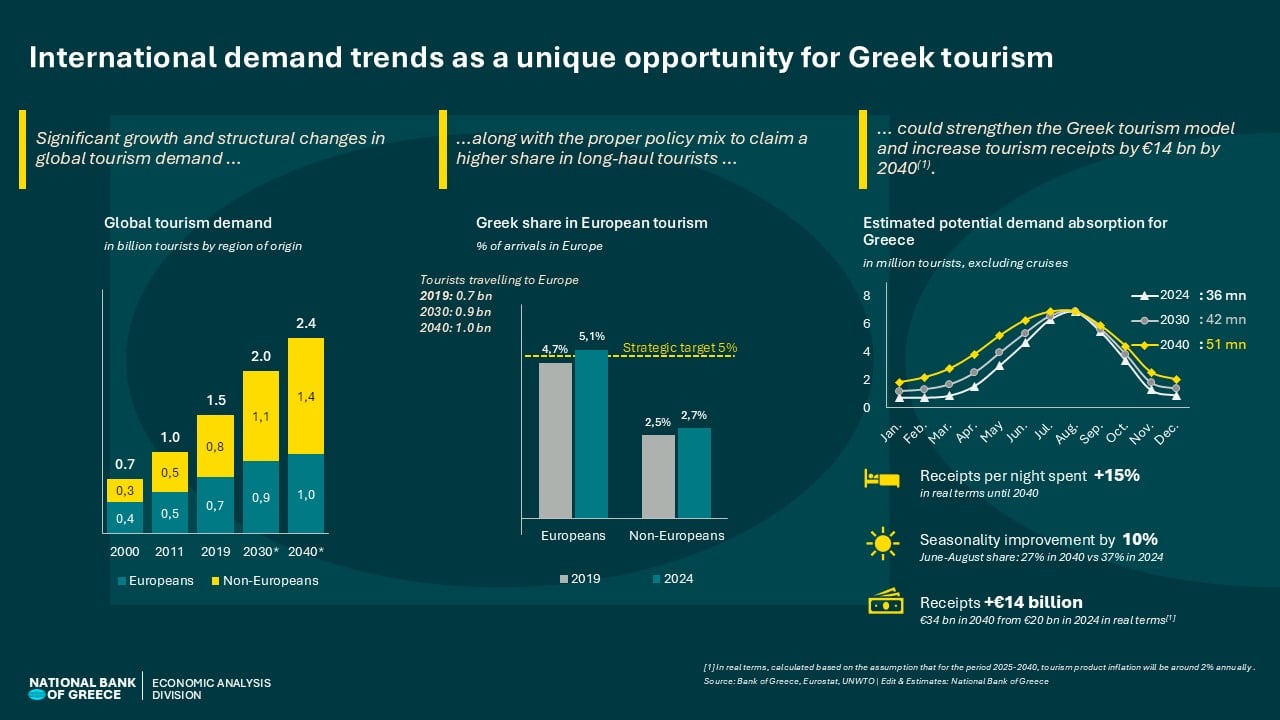

- Global tourism is expected to remain on the dynamic trend of the past two decades, reaching 2.4 billion tourists by 2040 (up from 1.5 billion in 2024), driven by (i) global population growth (from 8 billion today to 9 billion in 2040), and (ii) the expansion of the middle class (from 45% today to 60% of global population).

- Tourism demand is to be primarily fueled by non-European tourists, pointing to structural changes in the global tourism industry, as most travelers tend to choose destinations within their own continent.

Under these conditions, Europe must attract 30% more European tourists and twice as many non-European tourists by 2040 compared to today, to maintain its share in the global market as a destination for both short-haul and long-haul travel.

In this context, Greece has significant room to expand its still-low share in the growing market of non-European tourists visiting Europe (currently at 2.5%, compared to 5% for European tourists), following the example of countries like Portugal. Aligning its share in both markets at 5% – alongside global tourism growth – could create nearly 19 million additional potential tourists for Greece by 2040. Greek tourism should not “waste” this momentum by merely aiming for new “easy” arrival records. The transformation in global tourism provides a unique opportunity to upgrade Greece’s tourism model, as:

- Half of the new potential demand comes from non-European tourists (covering just 8% of Greece’s current tourist mix), who exhibit lower seasonality and higher average spending (1.8 times higher than air arrivals from European tourists and 2.3 times higher than road arrivals).

- Greece is making significant investments in air transport infrastructure, focusing on direct connections with long-haul markets (e.g. Athens International Airport and the new Castelli airport).

- A redistribution of tourist flows is occurring in the region, with new emerging destinations attracting part of Mediterranean demand (e.g. arrivals in Albania surged +82% in 2024 compared to 2019), while they primarily absorb lower-income tourist flows.

By leveraging the increasing demand from long-haul travelers, Greek tourism has the potential to be upgraded, attracting higher-quality visitors from both European and non-European markets. With a targeted revision of the national strategy, this goal is achievable, with significant benefits, particularly in addressing structural challenges:

- Seasonality will gradually shift away from the traditional “sun & sea” model, moving toward a pattern similar to that of other Mediterranean countries (aligning with climate conditions) with July-August representing 27% of total annual arrivals, down from 37% today.

- Average spending per overnight stay is expected to increase by 15% (in real terms), leading to a projected rise of €14 billion by 2040 in tourism receipts (€34 billion, up from €20 billion in 2040).

Achieving this growth will require a comprehensive upgrade of hospitality infrastructure (including maritime and road transport, and energy, water and waste management systems) to match the expansion of entry-point infrastructure (mainly airports). Given the scale and complexity of these upgrades, local government support and direction will be crucial.

See the infographic: