In a year marked by historically high levels of global uncertainty, the latest survey of Greek SMEs conducted by the Economic Analysis Division of the National Bank of Greece highlights the resilience of Greek entrepreneurship. Despite a demanding external environment, small and medium-sized enterprises (SMEs) have maintained a stable business climate and continue to pursue growth-oriented strategies. The report evaluates how businesses responded to recent pressures and assesses the sector’s starting point for 2026 — a year that still calls for flexibility and strengthened resilience.

SME Confidence holds firm in line with global trends

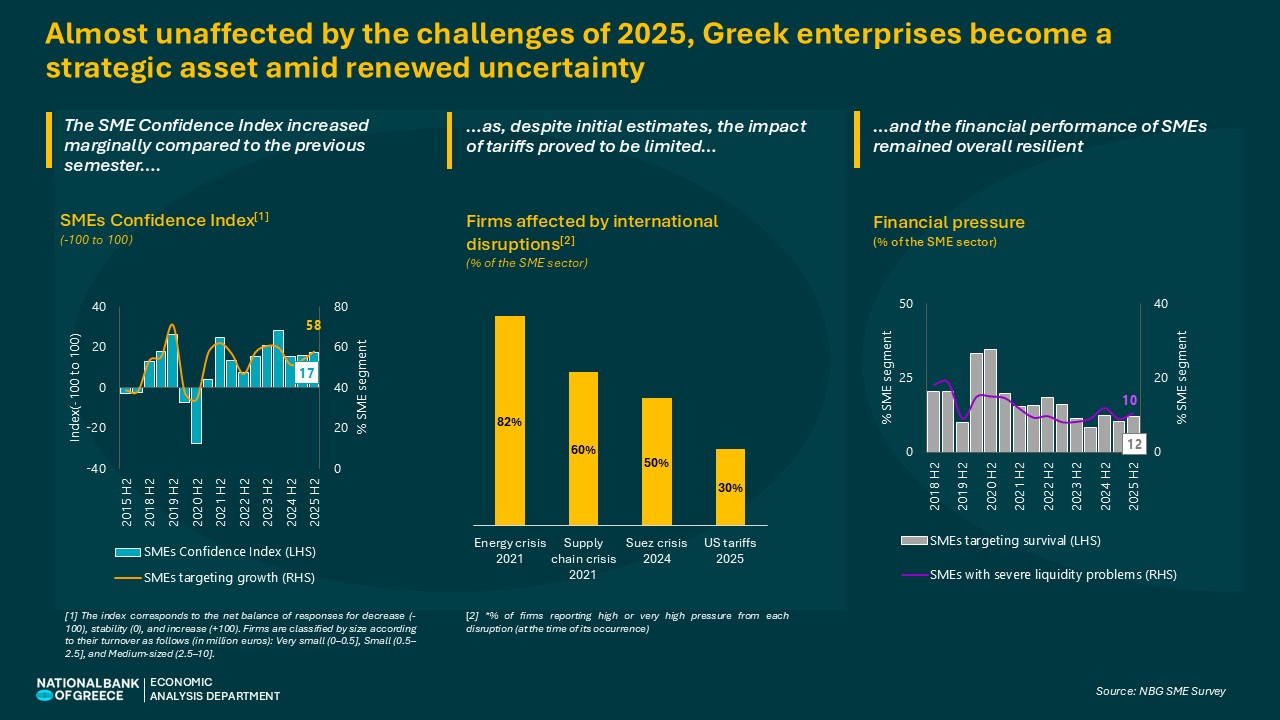

The overall business climate remains stable, with the SME Confidence Index edging up in the second half of 2025 (from 16 to 17 points), well above the historical average of the past decade. At the same time, the share of businesses pursuing growth strategies increased to 58%, compared with 54% in the first half of the year.

However, the gap between very small enterprises and larger firms continues to widen. Very small businesses reported a decline in both confidence and growth expectations, underscoring the greater challenges they face in adapting to the evolving economic landscape.

Notably, the ability of SMEs to sustain positive expectations comes at a time when the Global Uncertainty Index surged to unprecedented levels — reaching as much as 600% above its long-term average in September 2025. This resilience is not unique to Greece, rather, it aligns with the upward trajectory of the Global Economic Climate Index throughout the year, as the real impact of tariffs proved milder than initially anticipated. Factors such as interstate agreements and precautionary inventory stockpiling helped contain the intensity of pressures, leading to gradual upward revisions of global GDP growth for 2025 (to 3.3% from 2.8% in April). This improving backdrop is also reflected in the increasingly positive sales expectations reported by Greek SMEs over the course of the year.

Tariff pressures largely absorbed by profit margins, minimizing spillover effects to the wider economy

The survey finds that the impact of tariffs on Greek SMEs has been relatively contained compared with the major external shocks of the past five years. Only one-third of businesses reported significant operational pressure — substantially lower than the 82% affected during the 2021 energy crisis and the 50–60% impacted by supply chain disruptions between 2020 and 2024.

For the businesses that were affected, supply chain disruption emerged as the primary transmission channel: 83% mainly reported cost increases, while only 17% identified effects on demand, whether direct or indirect. Particularly insightful are the findings regarding SMEs’ response strategies:

- 22% actively reacted - notably, 8% strengthened their competitiveness, while 14% sought new suppliers or customers.

- 15% adopted a necessity-driven strategy by passing on higher costs, primarily those experiencing more intense pressure (23% versus 8% of firms facing lower-impact effects).

- The dominant strategy, adopted by roughly two-thirds of the sector, was to absorb higher costs by reducing profit margins, effectively acting as a buffer that prevented the disturbance from spreading across the broader business sector.

The resilience amid a challenging environment provides defenses against continued uncertainty

Despite pressure on profitability, SMEs remain largely resilient in terms of financial health. The proportion of businesses facing severe liquidity constraints or operating in survival mode remains close to the historic low of 10%, pointing to solid underlying fundamentals.

As 2026 begins under the weight of accumulated economic and geopolitical risks, Greek entrepreneurship possesses both the necessary response capacity and the strong adaptive reflexes developed under the demanding conditions of recent years. This resilience constitutes a strategic asset for the broader economy, strengthening its ability to respond effectively to another year of uncertainty.

See the infographic: