The World Uncertainty Index reached historically high levels during the first five months of 2025—particularly following the U.S. tariff announcements on April 2—recording values more than three times the average of the past decade. It even surpassed levels seen during crises such as the COVID-19 pandemic or the 2008 financial crisis. This deterioration in international uncertainty conditions is confirmed by 55% of the SME segment with half of it attributing it directly to aggressive tariff policies and the other half to geopolitical risks.

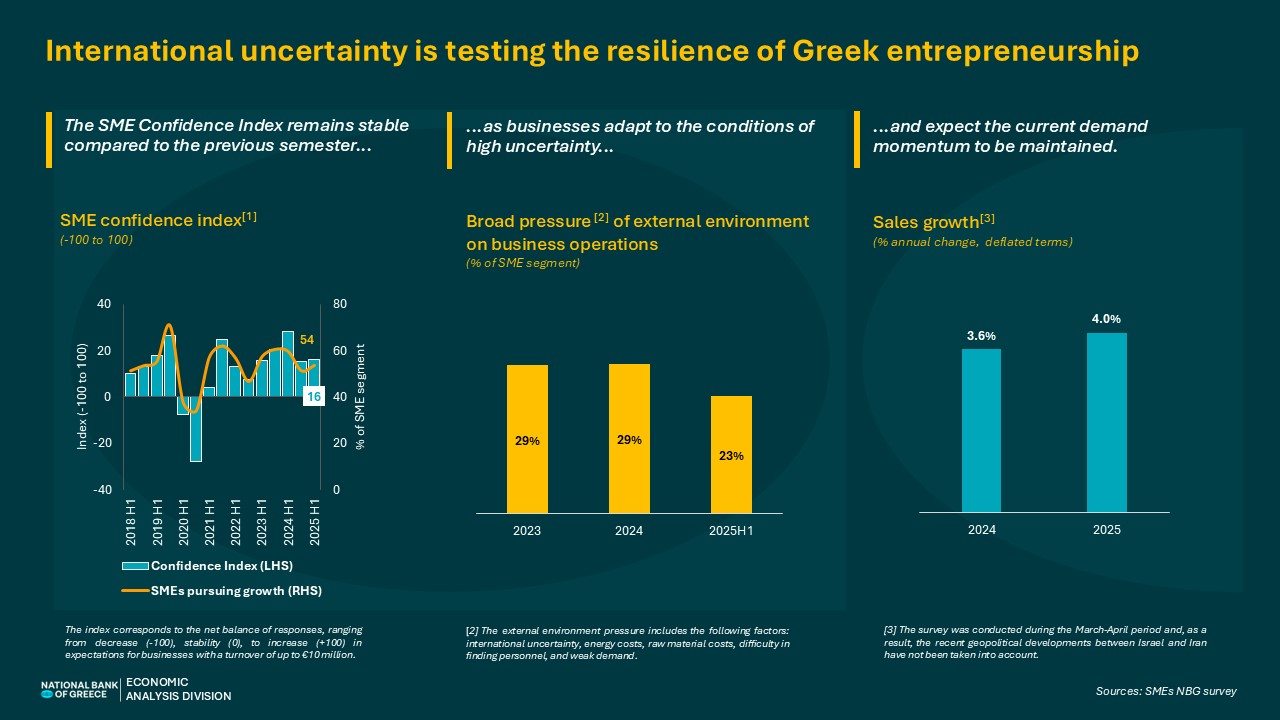

Through the regular field survey on Greek SMEs, it has been observed that this unprecedented global volatility of the current period is not being reflected in a similarly catastrophic impact on the operational figures of Greek businesses. Specifically, the gradual successful management of pressure from factors that had severely impacted Greek businesses in recent years (such as high energy prices) appears to be offsetting the current uncertainty stemming from tariff policies. As a result, only 23% of the segment reports broad pressure (from multiple external environmental factors) on business operations, compared to 29% over the previous two years. This indicates that the resilience of businesses has strengthened—partly due to the experience gained from past successive crises. This view is supported by historically low levels (around 10%) in indicators that provide early warning signals regarding financial health: namely, the share of the sector aiming for survival and the share experiencing severe liquidity problems.

Under these conditions, business sentiment remained relatively stable in the first half of 2025. The SME Confidence Index monitored by the National Bank of Greece (NBG) remained at 16 points—unchanged from the previous semester—and significantly above the average of the previous decade (7 points). At the same time, the majority of the segment actively pursues growth, recording a slight increase against the previous semester (rising from 51% to 54% of SMEs).

Looking ahead, SMEs remain optimistic about the future. The Future Demand Index shows upward momentum, reaching 31 points (up from 17 in the previous half), indicating optimism about a reversal of the downward trend seen over the past 1.5 years. Simultaneously, the share of SMEs that consider weak demand a pressing issue has declined to 32% of the sector (from 41% over the previous two years), suggesting that SMEs interpret the expected improvement in demand conditions as having structural characteristics.

In this context, Greek businesses are expected to maintain their growth momentum, with an increase in real (inflation-adjusted) sales of 4% in 2025, compared to 3.6% in 2024—a performance aligned with the general trend in the business sector. This expectation is conditional on the avoidance of further escalation in geopolitical tensions (such as those centered around the Middle East). Otherwise, business expectations may be overturned—an outcome that, based on previous experience during periods of global uncertainty, cannot be ruled out. However, barring extreme disruptions, Greek businesses have demonstrated that, by capitalizing on the experiences of the past decade, they possess the capability to successfully navigate complex and unstable environments.

See the infographic