2025 is expected to close with export growth of around 2.0% for Greek goods (excluding petroleum), reversing the 0.8% decline recorded in 2024 (in real terms). However, 2025 appears to be a two-speed year: following a strong 1st half during which exports grew by 3.9%, the 2nd half of the year is expected to remain close to last year’s level. This pattern largely reflects the inventory building strategy by importing businesses prior to the announcement of the EU-US trade agreement in July, and the subsequent unwinding of this trend over the remainder of the year (with the highest pressures expected in the 3rd quarter). Although this agreement had limited direct impact on Greece, it significantly reduced uncertainty regarding the possibility of an extended trade war and the ensuing effects on inflation and supply chain distribution. From this perspective, it is estimated to be a key driver of the short-term volatility observed this year.

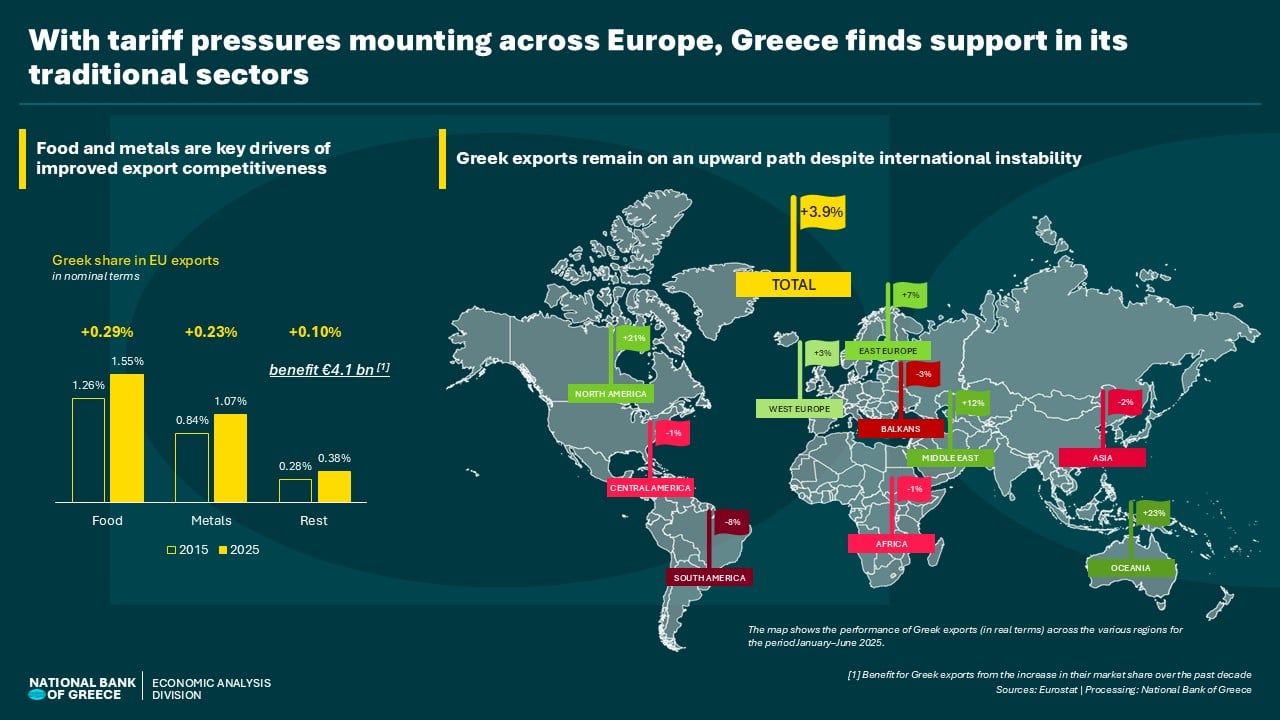

A prominent feature of the current environment is the resilience of Greek exports during a period of geopolitical tensions and a stronger euro. Greece recorded the 5th highest export performance in Europe during the 1st half of 2025, achieving a top 10 performance in 5 out of 10 broad sectors. As a result, the market share of Greek products against their European competitors increased to 0.6% (from 0.4% in 2015) – a significant increase in market share during the last decade, which adds €4.1 billion to the country's exports this year.

Behind this strong performance in the 1st half of 2025 lie the two traditional pillars of Greek exports: food and metals. Specifically:

- Food recorded a 10% increase, confirming the competitiveness of products such as olive oil, dairy, and fruits.

- Metals grew by 7%, maintaining a strong momentum both within and outside the EU (especially in the USA, the UK, and Norway). The sector is steadily strengthening its position in European exports, reaching 1.1% in 2025 (from 0.9% in 2011).

Their momentum remains notable in the 2nd half of the year, with early indicators suggesting that both sectors continue to improve their competitive position, climbing to the 3rd place in Europe’s export-performance ranking.

The performance of metals is particularly significant, as it is a globally competitive industry in which few countries of Greece’s size manage to achieve and sustain high export levels (around €6 billion annually over the past 5-years, in 2024 prices). This example shows that Greek industry can maintain a strong presence in large-scale strategic markets, even during periods of intense pressure.

See the infographic: