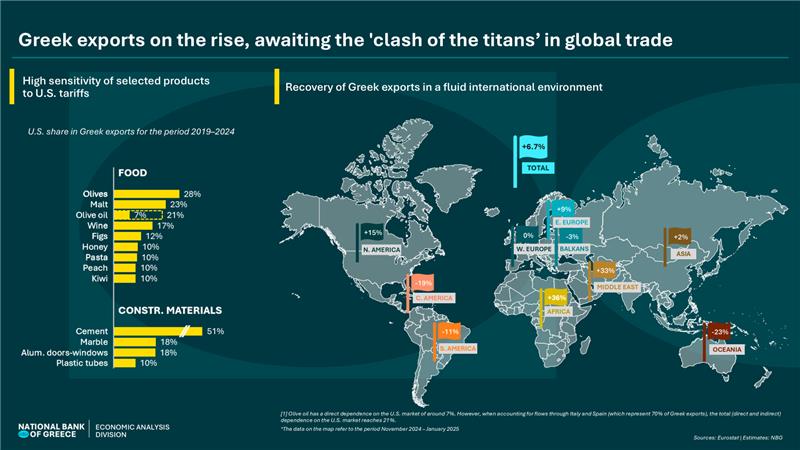

Greek exports recorded a 6.7% increase in real terms in the last quarter (November 2024–January 2025), continuing the recovery trend that began in July (July–October 2024: +5.3%) following a challenging start to the year (January–June 2024: -6.7%). This upward trajectory enabled Greece's share in EU exports to rise to 0.56%, up from 0.53% during the same period last year. Digging deeper into the quarterly performance:

- At the sectoral level, most sectors showed growth (in real terms), with the strongest momentum observed in food products (+18% in real terms), which accounted for two-thirds of the overall increase (a quarter of which came from olive oil, rebounding after a drop the previous year). Metals (+8%) and chemicals (+18%) also posted strong performances, contributing 1.3 and 0.8 percentage points respectively to the total growth.

- Regarding export destinations, as the performance of key European markets in Western Europe and the Balkans (which account for 3/5 of Greek exports) has remained sluggish for the past 1.5 years, exporters sought to offset losses through alternative markets. Beyond the consistent support from markets in Eastern Europe and the Middle East, North America's contribution was also critical—though this is now in question due to the unprecedentedly aggressive U.S. tariff policies.

The U.S. market has emerged as a dynamic destination for Greek products over the past six years (2019–2024), absorbing 5.3% of Greek exports in 2024 (up from 4.5% in 2019) and contributing 7% of the total export growth during that period. Despite this momentum, the overall share of the U.S. in Greek exports remains relatively low compared to Europe (as the U.S. absorbs 20% of European exports), shifting analysts’ focus primarily to the greater potential indirect effects of tariffs—through the economic impact on Greece’s key trade partners.

However, through a more detailed approach, the National Bank of Greece identifies 23 specific products that are potentially vulnerable to the direct effects of tariffs, as they have maintained over the past six years in the U.S.: (i) a consistent export presence, (ii) cumulative exports exceeding €10 million, and (iii) high dependence (over 10% of their total exports). These products mainly belong to the food, construction materials, and electrical equipment sectors. Specifically:

- In the food sector—which also holds the highest volume of exports to the U.S. (€3.2 billion cumulatively from 2019 to 2024, accounting for 7% of total food exports)—nine vulnerable products have been identified based on the above criteria. The most significant are olives and olive oil, each with cumulative exports of around €1 billion to the U.S. over the six-year period (with exposure levels of 20–30%), factoring in indirect olive oil flows via Italy and Spain, which absorb 70% of Greece’s olive oil exports. Other foods with high U.S. exposure include wine (17%) and fruits such as processed peaches, kiwis, and figs (10%).

- In other sectors, notable products include cement (with the U.S. absorbing half of exports, which reached €0.6 billion over six years), marble (18% exposure), electrical equipment such as resistors and circuit connectors (with 80% and 30% exposure, respectively), and other consumer goods (e.g., jewellery, furs) with exposure ranging between 10–25%.

Therefore, to the extent that these products are subject to substitution, they are confronted with a dual challenge: they may need to redirect a significant portion of their exports to new markets – and to do so under particularly pressured conditions, as their competitors will be doing the same - leading to downward price pressures and higher supply chain costs.

See the infographic: