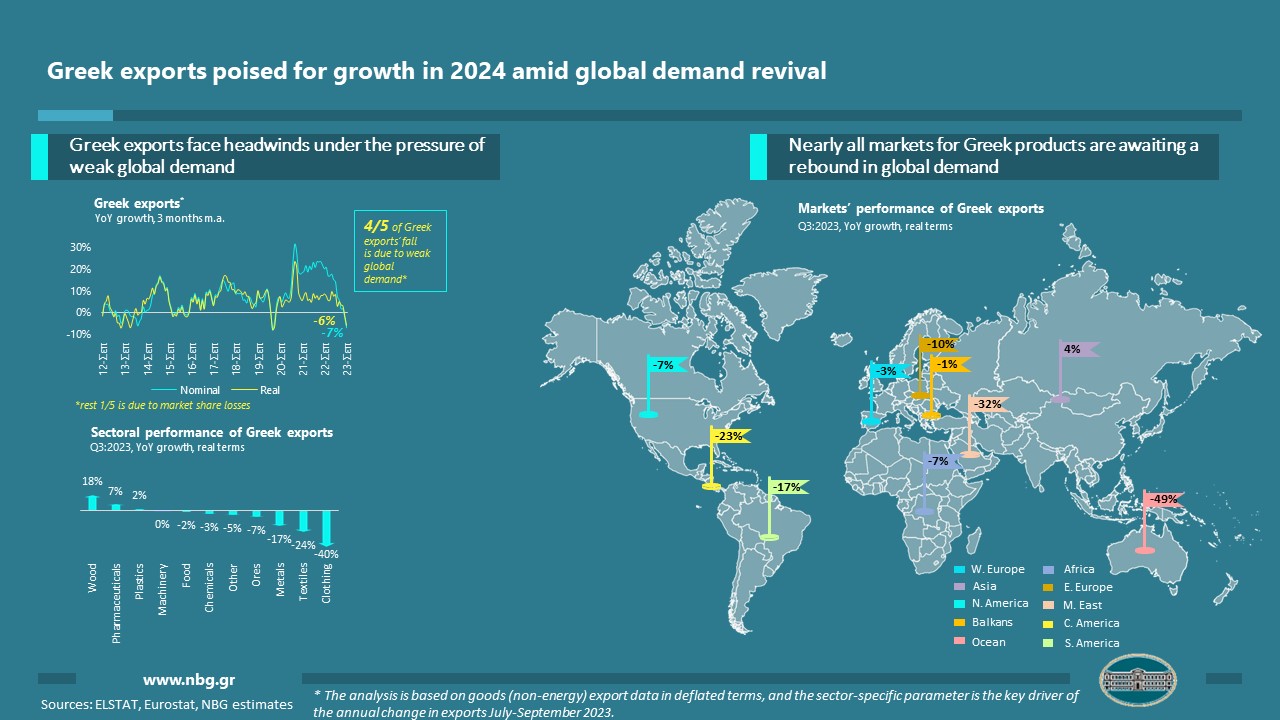

the challenging global situation continues to impede Greek exports (excluding oil), resulting in a consistent loss of momentum (-6.1% in Q3:2023, in deflated terms vs the same period in 2022). Approximately 4/5 of the current slowdown is attributed to reduced international market demand, with the remaining 1/5 stemming from sectoral market share losses.

This restrictive environment led to a decline in exports in nearly all destination markets of Greek products, while sectoral performance shows varying trajectories:

- In some sectors, Greek exporters lose market shares against their European competitors, resulting in significant negative performances. In this category, major sectors such as clothing and metals stand out (-40% and -17% respectively, in deflated terms), accounting for most of the decline in total Greek exports. We note that part of the decline in clothing exports may be related to the redirection of global value chain flows (as there is also a decline in clothing imports to Greece from non-EU countries).

- Some sectors manage to gain market share despite market pressure, with notable performances in pharmaceuticals and wood/paper (+7% and +18% respectively, in deflated terms), thus achieving an overall positive performance. It's important to highlight that the combined market share gains from these two sectors, along with food, serve as a significant counterbalance (of c. €0.3 billion) to the total exports’ decline.

As for the fourth quarter of the year, the marginally negative October (-0.4% on an annual basis and in deflated terms) is expected to be followed by a period of more intense downward pressures, as the impact of reduced olive oil and olives production begins to manifest. More precisely, the influence of this factor, coupled with the disturbances in agricultural production in Thessaly, is anticipated to subtract 3 percentage points from the growth in Q4:2023. This adjustment leads to our projection of -3% compared to Q4:2022, consequently maintaining Greek exports for 2023 at levels akin to the preceding year (i.e. a modest increase of 0.3% in deflated terms).

Looking ahead to 2024, the anticipated resurgence in global trade (projected at +3.4% annual volume growth compared to +0.8% in 2023) is poised to substantially uplift Greek exports. However, three factors are foreseen to somewhat impede this momentum:

- In the first months of the new year, exports will remain under pressure (partly due to reduced olive oil and olive production, costing about 2 percentage points of annual growth) – a trend confirmed by the lower performance of Greece’s export orders (compared to the EU).

- The market share losses in major sectors such as clothing/textiles and metals calls into question the strength of their recovery.

- Uncertainty in the international environment will continue to be present (mainly regarding geopolitical instability, high interest rates, and inflation).

Given these conditions, Greek exports are projected to steadily gain momentum over the course of next year, with an estimated 2-3% increase in 2024 (in deflated terms). However, this growth is expected to fall short of their medium-term trend of 5% annual growth.

See the infographic: