EXPRESS Business Loan

You can quickly and easily get the first business loan that is available entirely online.

The product at a glance

This is a working capital product with which you can boost the liquidity of your business. It operates with an overdraft limit linked to the company's current account through which your transactions are carried out.

From €6.000 to €35.000.

Each month you pay only interest (minimum payment of €50) and the capital is repaid, within the financing limit, according to the needs of your business.

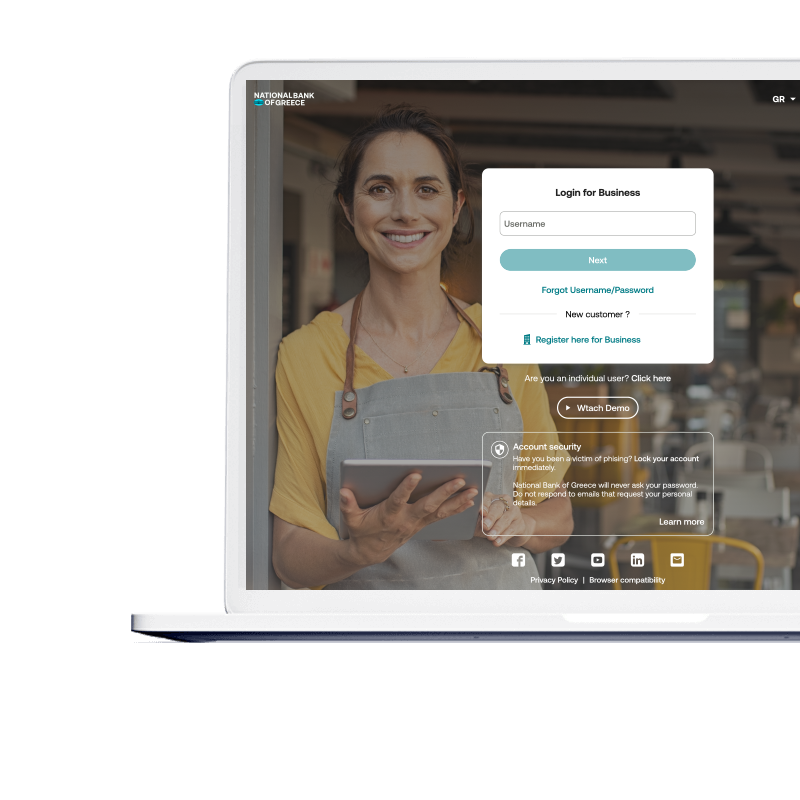

You can complete the whole process online

You just need to have Digital Banking credentials for your business, to get a business loan from €6,000 to €35,000 for a year without even visiting an NBG branch.

Loan amount from €6,000 to €35,000

Only pay interest every month

Loan repayment dependent on liquidity

EXPRESS Business Loan in 3 steps

Digital Banking on your computer, tablet, and mobile

With one application, you have a host of benefits.

I can carry out my business’s transactions, wherever I am

I don't waste time visiting the bank

I can view my business account statements 24/7

I have a full picture of my business’s banking products

I manage my business’s finances at a glance

I have instant access to my business’s income and outflows

Do you want more information?

It's the first loan you can get fully digitally, from application to disbursement * terms and conditions apply.

The costs you will need to pay are €150 on an annual basis. The fees will be charged for the first time to the account in the month in which the account is debited and then on each anniversary of the account opening, regardless of whether there is a debit balance.

Up to €35.000.

For the movement of the company's account, a monthly statement is issued which is provided free of charge.

Only collateral is required. If you are a legal person submitting the application, then one of the company's proprietors should participate as a guarantor. Note that the company's proprietor must have at least a 20% share in the company's ownership.

Digital Banking is simple and easy

Do you have a couple of minutes? Check out how easy it is to bank digitally.

00:00![Acquire Digital Banking codes]()

Acquire Digital Banking codes

00:00![Get a Business Express loan]()

Get a Business Express loan

00:00![Open your first business account online]()

Open your first business account online

For you and your business

Useful articles, ideas and suggestions

Business liquidity: How can I enhance it quickly?

Discover tools and solutions to boost your business’s capital.

Learn moreYour business’s financial flexibility

Find useful information on available funding opportunities.

Learn moreYour Business Banking RM is waiting for you

Always ready to answer any questions you may have

Your Business Banking RM will propose ideas and provide you with guidance on the options that best suit your needs. With their direct support and specialized knowledge, you can define your goals and set up the right plan to achieve them.

Close

Close